” Generally speaking, when you access 183 days (greater than fifty percent the 12 months) while in the condition in which you’re Operating remotely, that point out may consider you a resident and tax your whole profits. that can help keep away from probable penalties, observe your times invested Doing work in several places cautiously and talk to your tax advisor about the most recent policies within the states where you’re living, where you’re Doing work remotely, and the place the company is found, Navani implies.

It’s essential to keep great records on your deductions particularly when you don’t receive some sort of receipt as with a few charitable contributions and charitable or medical miles.

The IRS also acknowledges that it acquired your return, a courtesy you don’t get Even when you send your paper return by certified mail. that assists you protect your self through the desire and penalties that accrue if your paper return receives dropped.

several deductions exist that you may not be aware of, and several other of them are really typically overlooked. The deductions you qualify for will make get more info a big variation in your tax refund. They incorporate:

The percentage of such charges that is definitely deductible is predicated within the square footage on the Workplace to the overall region of your home.

as an example, if a person partner has plenty of clinical expenses, for instance COBRA payments ensuing from a career decline, computing taxes independently may enable for a larger deduction.

“this way, you might gain an instantaneous deduction and you can spread out the giving with the DAF over the following various a long time.” naturally, none of these selections should be produced according to taxes on your own, Navani stresses. So make sure to speak to your staff prior to making any selections.

intuit.com within sixty times of acquire and stick to the process mentioned to submit a refund ask for. you will need to return this merchandise utilizing your license code or order amount and dated receipt.

a lot of Individuals don’t must file a tax return each and every year. the truth is, you might not ought to file a tax return Until your overall revenue exceeds certain thresholds, or else you satisfy certain filing demands.

you only need to answer simple concerns, which include no matter whether you have had a infant, acquired a home or experienced A few other lifetime-modifying function in the past yr. TurboTax will then complete all the correct kinds to suit your needs.

standard IRA contributions can minimize your taxable profits, and you've got until eventually the tax filing deadline (Except if It can be delayed on account of a weekend or vacation) to open or lead to a standard IRA with the past tax yr.

house loan guideBest mortgage lendersBest lenders for FHA loansBest lenders for very low- and no-down-paymentBest VA home loan lenders

whenever, any place: Access to the internet needed; regular data fees use to down load and use mobile app.

Listed here are 10 tax tips for the new yr that may help you reduced your taxes, save cash when making ready your tax return, and keep away from tax penalties.

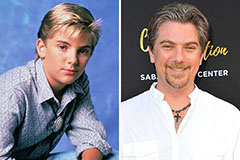

Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Elin Nordegren Then & Now!

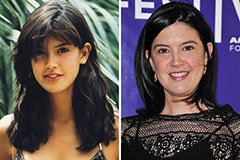

Elin Nordegren Then & Now! Phoebe Cates Then & Now!

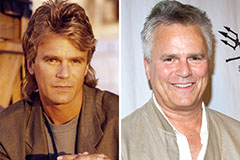

Phoebe Cates Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!